ActivMoney

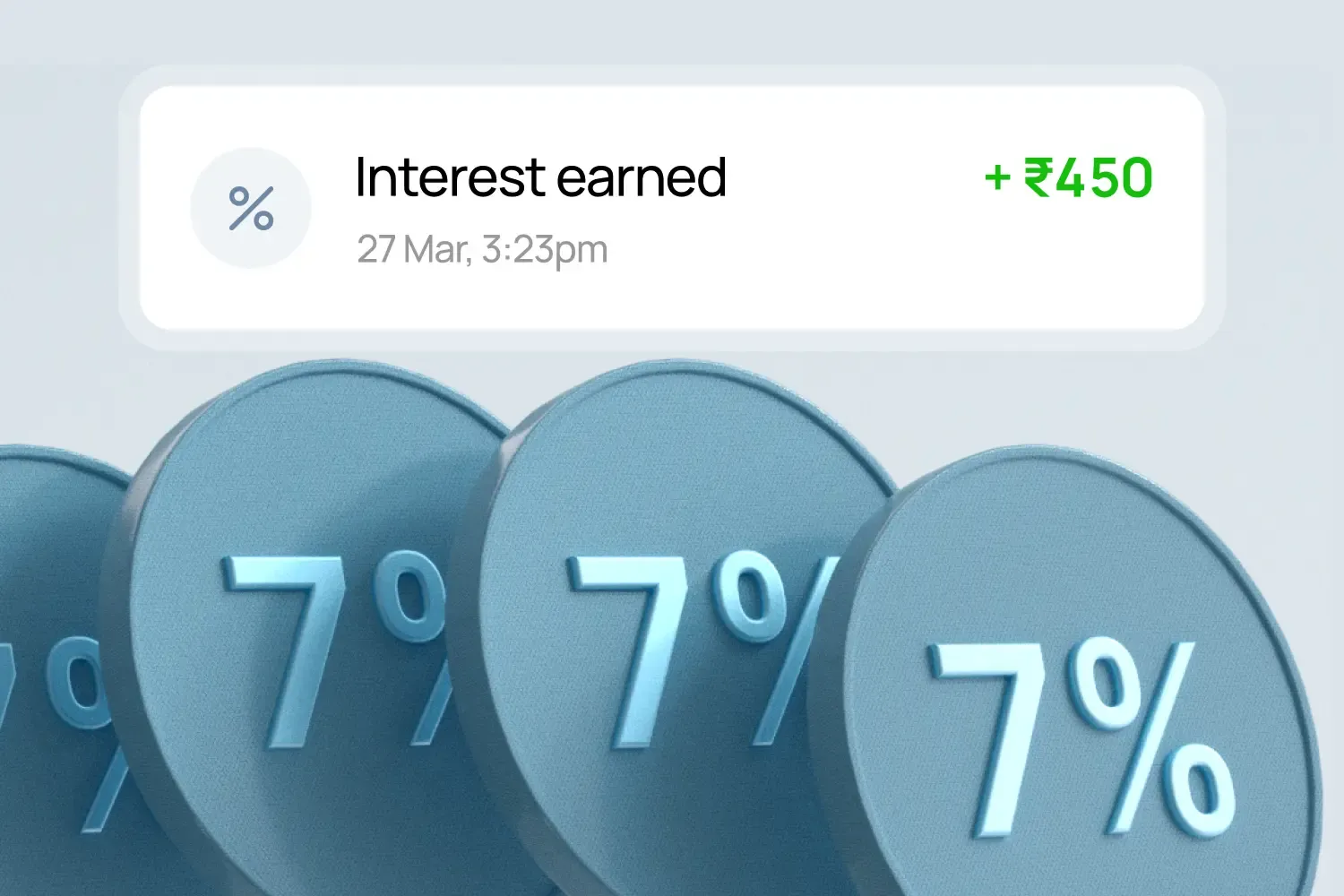

Enjoy up to 7%* interest p.a. on your ActivMoney

Receive interest in your savings a/c every 180 days

Shift funds in and out effortlessly, as and when needed

Pay zero charges on premature withdrawal

Earnings, boosted

Earn up to 7% interest p.a. on an amount over Rs.25,000 in your savings account. ActivMoney is automatically booked in multiples of Rs.5,000. Interest gets credited after a maturity period of 180 days.

Investing, reimagined

Invest with zero commitment of a lock-in period. Your deposits will be “swept in” automatically to make up for any shortfall of funds in your savings account.

Charges, eliminated

Pay absolutely zero charges on premature withdrawal of your ActivMoney. Continue to earn interest on your ActivMoney balance.

How ActivMoney works

A sweep-out limit of Rs.25,000/- is set

Your savings a/c balance must be Rs.30,000 and above to avail the benefits of ActivMoney.

ActivMoney gets booked in multiples of Rs.5,000/-

Suppose you hold a balance of Rs.45,000/- in your savings a/c. An ActivMoney of Rs.20,000/- will be booked, leaving a balance of Rs.25,000/- in your savings a/c.

Suitable ActivMoney is swept in

On a particular day, if someone issues a cheque for Rs.30,000 in your account, Rs.5,000/- from your latest ActivMoney will be “swept in” or used automatically to clear the cheque.

Interest is credited every 180 days

Make life easier. Get your 811.

Get Kotak811 A/cAsk Kotak811

Frequently Asked Questions

There's more than one benefits of opting for ActivMoney. Any amount from your savings account turned into ActivMoney earns a higher, FD-like interest rate of up to 7% per annum.

Because ActivMoney deposits are flexible and funds can be seamlessly shifted back into your savings account without any charges or fines whenever the need be, it offers you higher liquidity and comfort.

For a Kotak811 savings account, the default sweep-in limit is Rs.10,000, sweep-out limit is Rs.25,000 and ActivMoney is booked in multiples of Rs.5,000.

Flexi Fixed Deposit, better known as ActivMoney, is a facility where money over a certain limit in your savings account is parked as a deposit that earns a higher interest and gets added back to your savings if the balance drops below a certain limit. View all Terms and Condition

There are three ways you can enable ActivMoney or sweep-in facility for your account. 1. On the Kotak811 App under the 811 Tab 2. Calling the Customer Experience Center at 1860 266 0811 3. Visiting your nearest Kotak branch. To locate, Click here

You can disable the ActivMoney facility in your account by calling our Customer Support at 1860 266 0811.